State of the Tax and Customs Administration’s Investment Agenda

An audit of the Tax and Customs Administration’s Investment Agenda. The audit again showed that problems at the Tax and Customs Administration were due to delays in the implementation of the Investment Agenda and to its poor results, while there has already been a considerable outflow of personnel.

Underspend necessitates reform of the Investment Agenda

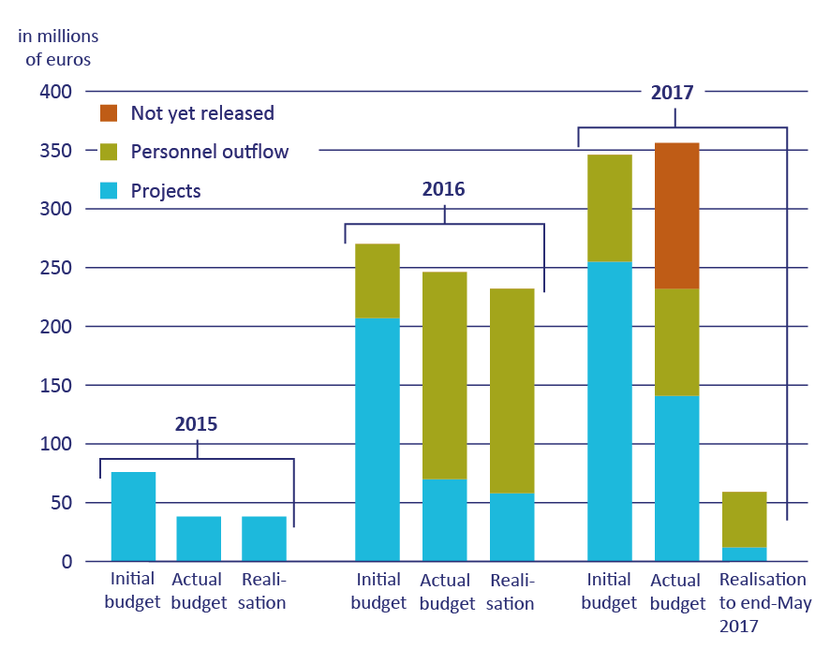

The financial figures presented in the audit report and the state of the project portfolio show in more detail that the Investment Agenda is making little progress and the modernisation of the Tax and Customs Administration is behind schedule. The financial information we used on actual expenditure was taken from internal documents that do not have a definitive status because they are not integrated into the Administration’s financial accounts.

Actual expenditure for the Investment Agenda is behind the initial budgets

The Investment Agenda is in urgent need of a thorough reform. We found that a serious attempt was being made to include the lessons learned in the reform. Many recommendations, for example, had been included in the policy paper on the Administration’s new senior management structure. But whether and how the new structure would bring about the required benefits will depend on the programme’s implementation. This is also true of the improvements in the governance and management information. To be able to monitor the business case when the Investment Agenda has been reformed, we recommend that governance and management of the programme be strengthened in the near future.

Why did we audit the Tax and Customs Administration’s Investment Agenda?

Via the State Secretary for Finance, the House of Representatives asked us to audit the regularity and efficiency of the expenditure incurred for the Tax and Customs Administration’s Investment Agenda (Ministry of Finance, 2016a). We replied that we would report on the regularity of the Investment Agenda expenditure in the 2016 government accountability audit and were already considering publishing a separate audit report on the Investment Agenda after the summer of 2017 (Netherlands Court of Audit, 2016a and 2016b). In May 2017 we decided to carry out this additional audit and to have it include the proposed reform of the Investment Agenda.

What are our recommendations?

Although the Tax and Customs Administration has taken measures to improve the governance and management of the Investment Agenda programme in 2017, our audit found that further strengthening was necessary. The main points for improvement relate to:

- anchoring the Investment Agenda accounts in the Administration’s financial accounts so that the budgets available for the programme and the actual expenditure can be reliably identified in the accounts;

- carefully recording the expected and actual organisational savings so that the benefits can be managed and the business case can be evaluated;

- strengthening the information provided on the additional tax revenue generated by the Investment Agenda;

- introducing systematic and structured external accounts to report to parliament on the progress and results of the Investment Agenda, based on the improved information generated by the above measures.

If these improvements are not made, it will be barely possible to monitor the Investment Agenda programme’s business case. There will therefore still be uncertainties about the costs and benefits of the Investment Agenda. To monitor the business case effectively after the reform, we recommend that governance, control, accountability and management of the programme be strengthened in the near future in tandem with the necessary reform work.

What standards and methods did we use to audit the Tax and Customs Administration’s Investment Agenda?

Our standard for this audit was that the Investment Agenda’s original goals and the progress made had to be clear. There also had to be clarity about the Investment Agenda’s budget and business case and its implementation. The standard we applied for the reform was that it had to include recommendations made in the past.

Current status

We received the state secretary’s response to our draft report on 6 October 2017. He agreed with our conclusions and recognised the urgency of our recommendations. In our afterword, we wrote that the state secretary should state when he would provide systematic insight into the programme’s progress based on reliable accounts.