Netherlands Court of Audit: reconsider vehicle tax exemptions, refunds and reductions

Most vehicle tax exemptions, refund regulations and tariff reductions are contrary to the taxes’ two main objectives: to provide the government with a stable stream of income and to contribute to the Netherlands’ air quality and climate goals. The Netherlands Court of Audit recommends that the State Secretary for Finance evaluate these special schemes and reconsider them if they are no longer appropriate.

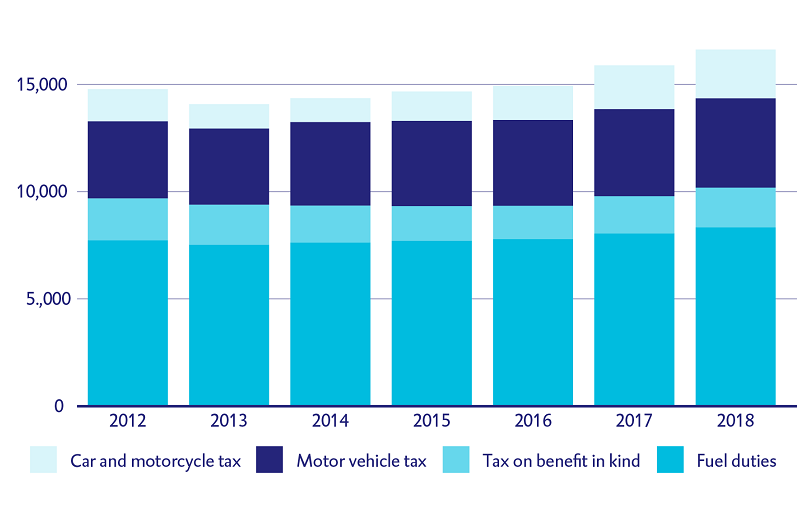

Vehicle taxes raised approximately €16.6 billion in 2018. With the exception of car and motorcycle tax (BPM), they generated a stable stream of income for the government. The stability of the BPM and duties will come under pressure, however, from government policy to substantially increase the number of electric cars.

Financial significance of vehicle taxes (in millions of euros)

A report published by the Court of Audit on 27 November 2019 looks at the financial incentives included in vehicle taxes. There are 54 vehicle tax exemptions, refund regulations and tariff reductions, covering everything from commercial vehicles, old timers, young timers and taxis to fire engines, ambulances and disability vehicles. In total, they were worth approximately €2 billion in 2018. Furthermore, there are other schemes whose financial significance is not known.

Most of the schemes have an impact not only on the tax revenue but also on the air quality and climate goals. The current scheme for young timers, for instance, makes the private use of older diesel company cars with a low market value more attractive. The resultant, older car fleet is undesirable for air quality and climate purposes.

Reconsider vehicle tax schemes

The Court of Audit recommends that the State Secretary for Finance reconsider the schemes if they are no longer appropriate and are no longer conducive to the vehicle taxes’ main objectives. Some of them were introduced many years ago and have not been evaluated recently.

Financial incentives of vehicle taxes not optimal

The current incentives in the vehicle taxes are not appropriate to improve air quality or realise the climate goals. They do not satisfy the “polluter pays” principle. As the BPM and motor vehicle tax (MRB) are not based on actual emissions of CO2 and other harmful substances, tax rates cannot be linked directly to them. Someone who drives only a few kilometres a year pays as much BPM and MRB as a frequent driver in the same type of vehicle.

Response of the State Secretary for Finance

In his response to the audit report, the State Secretary for Finance acknowledged that some of the schemes could be reconsidered. He observed that the Court of Audit had rightly concluded that some could be counterproductive to both the goal of a stable income stream and to the air quality and climate goals. Furthermore, they could lead to unfair tax burdens on individuals and businesses and made the system more complicated.