University real estate, 20 years after the transfer of ownership

Part 2: real estate management and governance

Dutch universities are planning to invest more than €3 billion in real estate in the coming years. This was an important reason to audit their real estate management.

University real estate management and its supervision by supervisory boards are in order but could be better

The main points of real estate management at the six universities audited by the Netherlands Court of Audit are in order but improvements could be made in some areas:

- not all the universities had adopted a real estate strategy at the time of the audit;

- information on the ownership of office premises was sometimes missing;

- in a number of cases, new educational and real estate concepts could be better applied (e.g. online learning);

- and, finally, supervisory boards could be involved more closely in complex financial arrangements.

The checks and balances in place for real estate decisions at the six universities are in broad lines in order but are open to improvement with regard to:

- the minimum size of investments requiring the supervisory board’s approval;

- documentation of decisions.

Information sharing within an organisation is essential to good real estate management

Why did we audit university real estate management?

Figures from the Education Inspectorate (IvhO, 2016) reveal that Dutch universities are planning to invest more than €3 billion in real estate in the coming years. Real estate investments are not a goal in and of themselves for universities but are made to support their core tasks: providing education, research and knowledge transfer for the benefit of society.

Experience in other educational sectors (e.g. at Leiden Regional Training Centre) shows that good real estate management cannot be taken for granted and poor decisions can have major ramifications for the institutions’ primary process and financial position. This, along with the size of the investments, was an important reason for us to audit real estate management at the universities.

On 1 January 1995, the Dutch central government transferred ownership of university real estate to the universities. Since then, the universities have been free to take their own decisions on the purchase, sale, renovation and construction of real estate.

Real estate is financed from the national education budget. The universities have a great deal of discretion in how they spend the lump sum funding they receive from the Ministry of Education. The 2018 budget for the university sector includes lump sum funding of €4.4 billion. Universities themselves have primary responsibility for the use of these public funds. A good system of checks and balances and an effective supervisory board are essential to ensure the money is spent correctly.

To provide an insight into the universities’ use of public funds, our audit therefore also considered how they organised checks and balances for their real estate decisions and, in a number of cases, the checks and balances functioned.

What standards and methods did we use in our audit of university real estate?

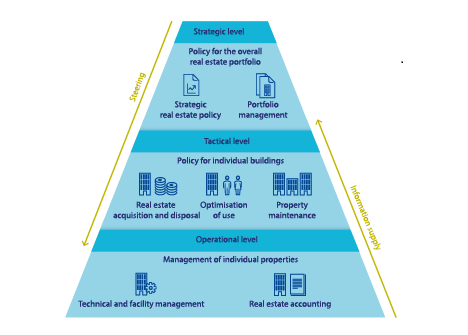

A detailed explanation of the standards framework we applied can be found in our Handreiking Basisprincipes Vastgoedmanagent (Basic Principles of Real Estate Management). To analyse and evaluate the universities’ real estate management and the checks and balances in place, we used a frequently used model consisting of three levels: strategic, tactical and operational.

- At strategic level an organisation sets its strategic real estate policy and carries out portfolio management. Decisions are taken at this level on the strategic core stock (the real estate that is necessary to achieve the organisation’s strategic goals) and on the steering of the underlying levels.

- At tactical level an organisation carries out property management (i.e. management of individual buildings). The available real estate is matched to the users’ needs in accordance with the frameworks set at strategic level. Real estate management includes taking decisions on acquiring and disposing of real estate, optimising its use (vacancy management) and maintaining the properties.

- At operational level an organisation operates individual buildings and land. This includes technical and facility management and accounting for the real estate.

The organisation must make clear agreements regarding the tasks, responsibilities and powers at each of these three levels.

- Effective checks and balances

Effective checks and balances at all three levels, as well as good real estate management, are essential to identify risks on a timely basis. The supervisory board or a comparable body has a critical role to play in this. Other actors involved in the checks and balances can often include the external auditor, an internal audit department and a controller.

Current status

The Ministry of Education, Culture and Science agrees with our analysis of real estate management and the checks and balances in place for real estate decisions. It considers the report and recommendations to be a valuable addition to the steps already taken in this area. The minister sees the recommendations and the manual published separately as useful tools for universities.

The Association of Universities in the Netherlands (VSNU) considers the Court’s audit to be an important supplement to the Campus NL study. It is pleased the Court concluded that real estate management and the checks and balances were in order at the universities. It also recognised the importance of remaining alert to potential risks.

The responses of the minister and the VSNU make it possible to take further steps towards improving the continuity section in the universities’ annual reports. We would be pleased to play a part in this.