Confiscation of the proceeds of crime

Much sown, meagre harvest

Under the motto ‘crime must not pay’, additional budgets of at least €634.1 million were released between 2010 and 2021 to confiscate criminal assets. But the results of the additional budget have not matched the Minister of Justice and Security’s expectations. The Netherlands Court of Audit found that a lot has been sown in the past 10 years but the harvest has been meagre.

Since 2010, 5 additional budgets have been released in order to confiscate as many proceeds of crime as possible. The Court of Audit investigated whether the additional budgets had achieved their financial goals.

The additional budgets of at least €634.1 million released between 2010 and 2021 ‘paid for themselves’, as €740.3 million was confiscated from ‘routine cases’. The political ambitions, however, were far higher. According to the Minister of Justice and Security (J&V), every additional euro would lead to the confiscation of 3 euros in criminal assets. The ministry confiscated more than €1.9 billion in criminal assets during the period audited, but most of that amount was due to 8 high and exceptional out-of-court transactions (e.g., with ABN AMRO, Vimpelcom). These transactions were the outcome of separate investigations and prosecutions and were not related to the additional budgets. The Court therefore did not include them in its audit.

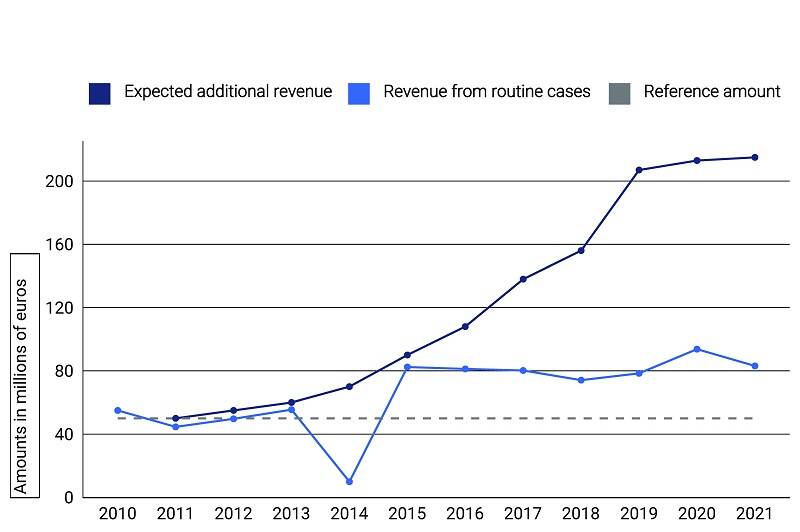

Expected revenue from 3 additional budgets not realised

The amount confiscated from routine cases has averaged at around €83 million per annum since 2015. The amount of criminal assets confiscated increasingly fell short of expectations in the second half of the period audited. The difference between the expected additional revenue and the actual revenue has exceeded €100 million in every year since 2019. This is disappointing, the Court concludes, because apart from releasing additional budgets the minister had widened the scope of laws and regulations and revised policy in order to make it easier to confiscate criminal assets.

It cannot be said whether the additional budgets were applied effectively and efficiently. It is not known what they were spent on. Furthermore, the law enforcement agencies, OM, judiciary and the Central Judicial Collection Agency all work with their own definitions, databases and IT systems. There are few signs that the justice system takes an integrated approach to confiscating the proceeds of crime. As very few evaluations have been made of the additional budgets, moreover, the ministry does not have an overall insight into the results of anti-money laundering measures.

The Court of Audit recommends that the Minister of J&V align policy formulation with policy implementation. In her response to the Court’s draft report, the minister concurs with the audit conclusions and writes that she will take measures to strengthen the confiscation system further. She notes, however, that she can only steer the management of the organisations concerned and that the OM is responsible for the effectiveness of confiscation measures. The Court believes the minister underplays her statutory powers and ability to steer the results of the confiscation system.