Little insight into impact of additional government funding

Accountability Audit: implementation brought to a standstill by lack of staff

The fourth Rutte government has had little success meeting all its ambitious goals. In practice, it was often unable to spend all the money budgeted for 2023. Ministers have little insight into what they achieved with the additional budgets to combat drug smuggling, support vulnerable regions, maintain roads and provide education for newcomers. Active and targeted support was provided to alleviate high energy costs for citizens and businesses.

Ministers reported well on the additional funding provided for paid parental leave, the reception of Ukrainians and gas buffer stocks but parliament received far less information on many other policy areas that received additional funding. The public benefits of the government’s additional funding are largely unknown. The government provided an additional €76 billion during its four-year term of office but at least €7.2 billion went unspent in 2023.

The caretaker government in office since July 2023 stated in the 2024 Spring Memorandum that the budget would again be underutilised in the years ahead and money would be spent later than planned. The Court of Audit’s Accountability Audit of 15 May 2024 warns, as it had in 2018 and 2019, that ministries and implementing organisations do not have the capacity necessary to meet the political ambitions. Staff shortages in particular meant they spent less of the additional funding provided by the government. The underspend was particularly striking at the Ministry of Defence, in the prison system, education, at the Tax and Customs Administration and in the healthcare sector. The proliferation of government rules and processes and legacy ICT systems, moreover, frustrate policy implementation.

Poor insight into impact of additional funding

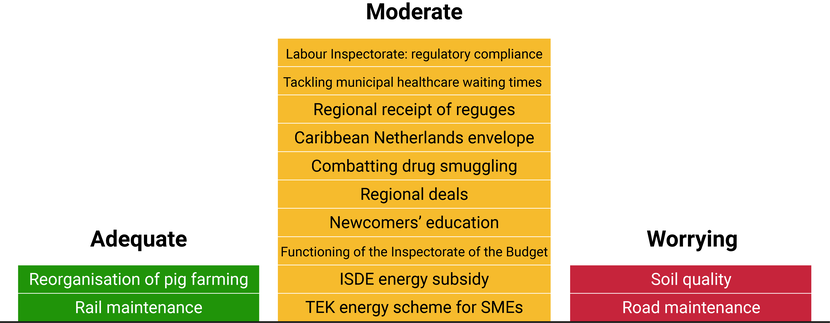

The ministers’ annual reports do not always state what results were achieved during the year. ‘Accountability Day is results day. The government’s annual report unfortunately provides too little insight into what public money achieves,’ says Pieter Duisenberg, the Court’s President. The results achieved by the additional funding provided for, for instance, school managers and social lawyers remains uncertain. The Court of Audit had to qualify 12 policy areas as ‘moderate’ and some even as ‘worrying’. The reason was that the additional funding’s goals were often vague and the results were often unknown. Where additional funding is mixed in with existing funds flows, it can no longer be isolated and monitored, not even if it achieves its intended results.

Opinion on selected policy areas

The audit found, for instance, that the Minister of Infrastructure did not have a full understanding of the poor state of bridges, tunnels and roads due to overdue maintenance. The minister’s insight into the reorganisation of pig farming (and how the government can learn lessons from it) and rail maintenance, by contrast, was ‘adequate’.

Policy implementation at a standstill: more government vacancies, more hired staff

The Court of Audit notes that in a number of cases policy comes unstuck in the implementation phase. Regulations are often complex. The benefit system and the measures taken to compensate victims of the childcare benefit scandal are a painful illustration of this. Furthermore, not enough civil servants or other implementers can be recruited to get the job done. In the past 4 years, the number of vacancies in central government has doubled to 32,000. More expensive temporary staff are having to be hired. Their proportion at several government organisations is well above the standard set for temporary staff (10%). It is uncertain whether the renewal of temporary contracts is permitted under the law.

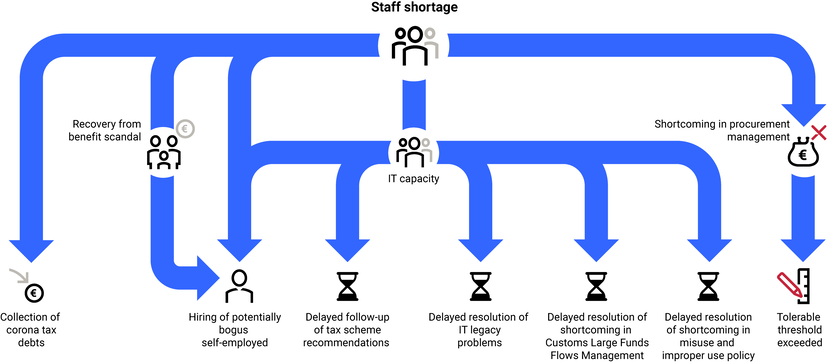

Results are disappointing and are not coming up to people’s expectations. A large implementing organisation such as the Tax and Customs Administration, part of the Ministry of Finance, for instance, is seeing significant staff outflow, with many people reaching retirement age. The Administration will have to replace nearly half its staff in the next 5 years. The departure of so many tax officials is a drain on the organisation’s knowhow and expertise. Many problems cannot be solved quickly. Staff shortages delay the replacement of legacy ICT systems, increase the cost of repairing the damage caused by the childcare benefit scandal, lead to the hiring of bogus self-employed workers, increase the risk of misuse by taxpayers and delay service improvements for people with tax problems.

In the Court of Audit’s opinion, it is a matter of concern that politicians are making new demands on the Tax and Customs Administration at the expense of essential ICT reforms, including modernisation of the systems in place for the 3 largest tax flows, together representing €165 billion in revenue.

Active and targeted measures: not every crisis response is effective

The government’s response to the energy crisis was active and targeted. Some support measures during the COVID-19 crisis and energy crisis are still being implemented. The Court of Audit had earlier concluded that the procurement of corona vaccines had been effective, but not every crisis response had been. In 2023, for instance, only €156 million was spent of the budgeted €1.4 billion TEK scheme for energy-intensive SMEs. Of this amount, moreover, the government will recover €100 million from recipients that were not entitled to the scheme. The Minister of Economic Affairs and Climate Policy’s accounts for the grant are in order but the scheme’s introduction came too late for the SMEs; gas and electricity process were already falling and the scheme missed its goal.

Large budgets ready to be spent

The incumbent caretaker government has earmarked many extra budgets from the 2022 coalition agreement for the years 2024-2028, on condition that plans are worked out for them. Additional funding is being provided for climate policy, clean water, biodiversity and reducing nitrogen deposition – the 2024 Monitor of Well-Being and the SDGs has reported a further deterioration in nature quality.

| Check how your taxes are spent! On 15 May 2024, the Court of Audit will launch a new web application known as Ons geld ontcijferd By answering a series of questions on your smart phone, tablet or PC, you can see what the government does with your taxes and contributions. The government spends €12,000 every second. Is it spent in accordance with the rules? How much is spent on education, care or defence? What are the results? What do you notice yourself? In a couple of swipes, Ons geld ontcijferd will show you how the government operates and performs. The interactive web app is enriched with information from the Accountability Audit that the Court of Audit will submit to parliament on 15 May. |

Improvement in regularity

The Court of Audit found improvements in financial management at the Ministry of Health, Welfare and Sport (VWS), which had experienced a severe shortcoming during the COVID-19 pandemic in the previous 3 years. One effect of the shortcoming was that the Minister of VWS could no longer verify the regularity of €2.1 billion in advance payments. Extra support from a financial management taskforce of the Ministry of Finance helped the Ministry of VWS and other ministries. There was an improvement in the regularity of expenditures. Central government expenditures and revenues remained below the tolerable threshold in 2023. The Court of Audit issued a qualified statement of approval on the central government accounts: the regularity of €2.6 billion in advance payments (e.g. for the municipal health service’s client contact operations) could not be established and the number of errors and uncertainties in €4.45 billion of expenditure commitments (e.g. for procurement contracts) exceeded the tolerable threshold. Parliament should keep its finger on the pulse more often and earlier and the government should pay more attention to the persistent problems in procurement procedures.

Fewer shortcomings in the ministries’ operational management

The downward trend in operational management shortcomings in central government continued in 2023. The Court of Audit did not find a single severe shortcoming this year. There were fewer problems in information management (use of IT systems) at various ministries and at the Senate and National Ombudsman. Responsible use of more algorithms in central government processes is a promising development, especially in the current tight labour market. The Court investigated the use of algorithms in youth care, traffic management and border controls. In its opinion, serious attention must be paid to IT management in order to prevent unauthorised access to data or algorithms. Without effective IT management and privacy rules, there is a risk that personal data will be corrupted or lost.

Operational management plans to make central government more sustainable failed to live up to expectations. Little came of a plan to use less gas for energy in prisons, for instance. Central government reports on CO2 emission reductions, moreover, are ambiguous. In total, all ministries together emitted 25% more CO2 than the Minister of the Interior reported in the Central Government Operational Management Annual Report.

Parliament taken by surprise too often

Too often, it seems that budgets and ambitions have to be revised. Too often, it seems that parliament and society are taken by surprise. Renovation of the Binnenhof parliament buildings and the reception of asylum seekers, for example, turned out to be far more expensive than expected. This is bad for trust. And budget revisions, the Court writes in its audit report, are often too late, too sudden and too ill-founded. In a time of major transitions, crises, difficult choices and pressure on public finances, government and parliament would benefit from an active understanding of the risks. They could then take the risks into account in the budget and accountability cycle.

The House of Representatives received nearly 300 policy evaluations from the ministers in the past year. More use could be made of them, especially if they are of high quality. With better insight into plans, results and risks, government and parliament can together think big, act realistically and learn and adapt in a timely manner. The Court of Audit therefore recommends that the motion on spending reviews passed by the House be taken seriously and the point and pointlessness of government expenditure in each policy field be comprehensively held up to the light. A new coalition agreement should lay down the additional expenditure, budget cuts and goals such that parliament can monitor their progress and results.

The Court of Audit again recommends that the audit of central government finances be organised so as to avoid duplication of work. This will ultimately strengthen parliament’s oversight. To learn the lessons of the past, Accountability Day should be held earlier in the year.