Non-tax revenues

Estimates, controls and incentives of ministries’ revenues

The Netherlands Court of Audit has investigated central government’s non-tax revenues. We investigated how much the ministries received in non-tax revenues, such as the advertising income earned by public broadcasters and income from the auction of CO2 emission allowances. All this public money is recognised in the ministries’ budgets. Some of the income is allocated to treasury but the ministers have budgetary responsibility for about half: if the actual income is more or less than estimated, there are consequences for their budgets. We investigated how the ministries estimated the income for which they have budgetary responsibility. Are the estimates influenced by incentives in the budgetary rules? And if the income is higher than estimated, what influence does the House of Representatives have on how it is spent?

Do ministries make realistic estimates of the non-tax revenues for which they have budgetary responsibility?

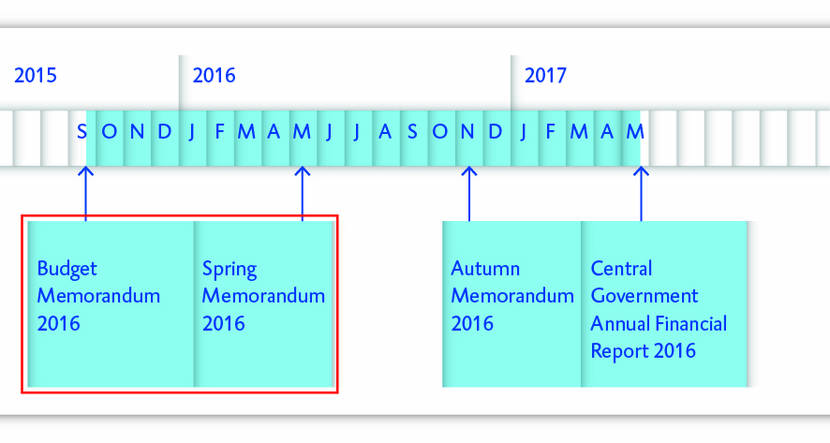

On the whole, the ministries systematically underestimate the non-tax revenues they receive. They receive the additional income throughout the financial year but a substantial proportion is not disclosed until the Autumn Memorandum or annual report is published. At the most important decision points in the year, on the publication of the Budget Memorandum and the Spring Memorandum, therefore, parliament cannot say how these funds should be spent. Between 2013 and 2016, the average amount at issue was €678 million per annum.

The debate of the Budget Memorandum and the Spring Memorandum are the most important moments when parliament can decide on the use of public funds

Why did we audit estimates of non-tax revenues?

Estimates of non-tax revenues have never been audited before. It is important that the House of Representatives and the Minister of Finance have an insight into them, as the House currently has no say on how considerable amounts of public money are spent.

What are our recommendations regarding estimates of non-tax revenues?

We recommend that the House of Representatives decide whether the estimates should be cautious or realistic. We also advise the House to be alert to the reasons given for the estimates during the debate of the Budget Memorandum and the Spring Memorandum. The House can still make amendments at these moments. We recommend that the Minister of Finance investigate the variances between the estimated and actual amounts and the timing of their disclosure.

What data did we use to audit non-tax revenues?

To carry out this audit, we requested the estimated and actual figures of all budgets from the Ministry of Finance. We analysed and processed these data and posted them on our website as open data.

Current status

The Minister of Finance responded to our audit on 24 August. He undertook to investigate the causes of the substantial variances between the estimated and actual amounts of non-tax revenues. We published our audit report on 14 September 2017.