Focus on the Tax and Customs Administration’s enforcement of false self-employment law

The Tax and Customs Administration’s approach to false self-employment in the engagement of specialists in various business sectors is meeting with little success. The Administration is making fewer and fewer checks regarding the engagement of self-employed persons. The likelihood that false self-employment will be detected is low.

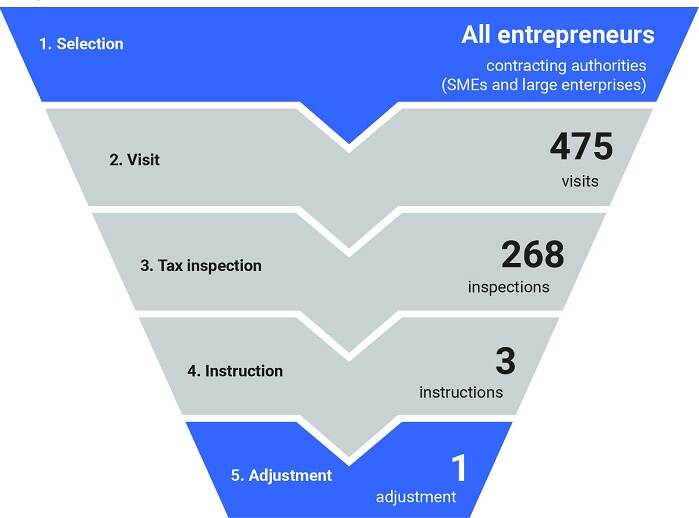

A law to strengthen enforcement at contracting authorities was introduced in 2016. In the face of popular opposition to the new rules, however, the government introduced an enforcement moratorium in the same year. As a result, tax officers are making fewer and fewer checks of whether contracting authorities are remitting salaries taxes and national insurance contributions when they should. The number of tax adjustments is low and the self-employed are being checked less often. The moratorium for contracting authorities has been lifted slightly in recent years. The Tax and Customs Administration can now give contracting authorities instructions to rectify a person’s employment status if it suspects false self-employment. However, the Administration gave only 3 instructions and made only 1 tax adjustment between the end of 2019 and 2021.

Employment status instructions and tax adjustments

The Administration has developed various tools for enterprises to receive advance assurance on employment status. The number of requests to use them has been declining since 2016.

Why did we investigate false self-employment?

The Netherlands counts more and more self-employed persons. There are currently 1.1 million, versus 8 million employed persons. Before 2016, 500,000 declarations of employment status had been issued to the self-employed. The declarations release employers from liability to fines and for salaries tax and national insurance remittances. They give contracting authorities assurances about a self-employed person’s employment status. However, they also encourage false self-employment. As contracting authorities run no tax risks, for financial reasons they are more inclined to engage self-employed persons, even for many hours and over longer periods of time. In cases of self-employment, the self-employed and the contracting authorities enjoy certain tax benefits, but not in cases of false self-employment. The Assessment of Employment Status (Deregulation) Act must put an end to false self-employment by making the contracting authorities partly responsible but it has not been enforced in practice owing to the opposition from enterprises and the self-employed.

What audit methods did we use?

The Court of Audit analysed the data in 1.1 million tax returns to see how often the Administration had adjusted the tax returns of the self-employed. We also held many interviews with various units of the Tax and Customs Administration and talked to industry associations and individual contracting authorities.

What data did we use for this investigation?

We requested and analysed relevant data from the Tax and Customs Administration and the Ministry of Social Affairs and Employment.

Current status

In a brief response, the State Secretary for Tax Affairs and the Tax Administration (Ministry of Finance) agreed with the findings of our investigation and undertook to act on them. The report was sent to the House of Representatives and the Senate on 5 April 2022. It has also been published on the Court of Audit’s website.

Other relevant reports have also been posted on the website:

Offenders scot-free, victims not helped

Social security and labour market flexibility