Tax incentives for electric vehicles remain an expensive instrument

Tax incentives for electric vehicles remain a relatively expensive instrument to cut CO2 emissions despite the measures taken in 2019 and 2020 to reduce their cost. The Netherlands Court of Audit recommends that the use of the current tax schemes for electric vehicles be reviewed.

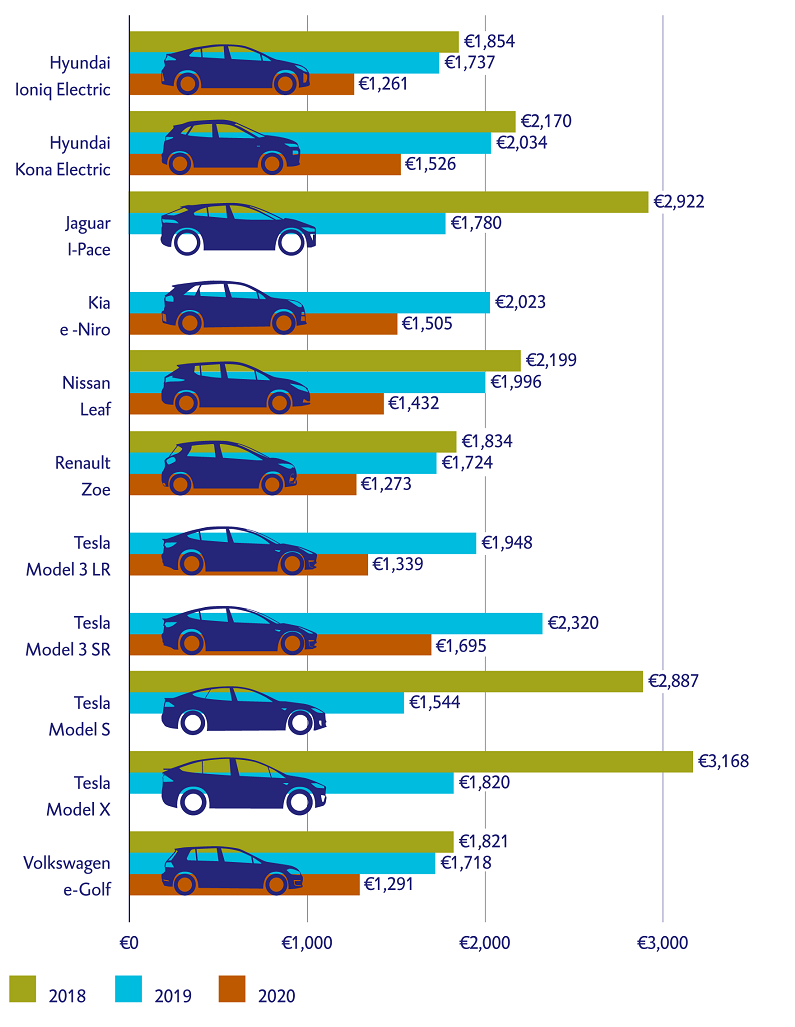

The Court of Audit has calculated the loss of tax revenue per tonne of CO2 reduction for 11 electric cars and compared the results with alternative petrol or diesel cars (the ‘counterfactuals’).

Decline in tax loss per tonne of CO2 reduction in 2019 and 2020

|

The figure does not include 2018 amounts for models that were not available in that year. Amounts for 2020 are not shown for some more expensive models (Jaguar I-Pace, Tesla Model S and Model X) because changes in the tax regime make it unrealistic to use the same counterfactuals as in 2018 and 2019. |

The tax loss per tonne of CO2 reduction was significantly lower in 2019 and 2020 than in 2018 owing to the introduction of measures to reduce the cost of the tax incentives. However, they are still considerably higher than the cost of CO2 emission allowances (€23 per tonne of CO2). They are also higher than the maximum grant of €300 per tonne of CO2 reduction that the Minister of Economic Affairs and Climate Policy set in the 2020 renewable energy scheme.

Recommendations on tax incentives for electric vehicles

The Court of Audit recommends that the State Secretary for Finance review the continued use of tax incentives for electric vehicles. If it is decided to continue the policy, a standard should be set for the tax loss per tonne of CO2 reduction, taking account of the current imbalance between business and private vehicle use. At present, business drivers enjoy the tax incentives for zero-emission vehicles more than private drivers, although the difference has declined since the introduction of measures in 2019 and 2020 to reduce the tax incentive.

Wider policy objectives

The state secretary wrote in response to these recommendations that the incentives for electric vehicles served more policy objectives than just the air quality and climate goals. They also promoted innovation, reduced reliance on fossil fuels and combatted noise pollution. The Court of Audit notes that insight into policy effectiveness is impeded if the policy objectives are widened or changed over time. The state secretary did not specifically respond to our recommendation to review the continued use of tax incentives for zero-emission vehicles.

No incentives for cleaner light commercial vehicles

The Court of Audit also found that the tax incentives for light commercial vehicles involved a lot of money. The total loss of car and motorcycle tax and motor vehicle tax exceeded €1.7 billion in 2019. Most light commercial vehicles run on diesel and are responsible for a significant proportion of the total emission of CO2, nitrogen oxide and particulates from road transport. The special rules currently in place for these vehicles are contrary to the air quality and climate goals of vehicle taxation.

The Court of Audit recommends that the State Secretary for Finance state the estimated loss of tax from light commercial vehicles in the budget memorandum and consider reviewing the special rules with a view to introducing tax incentives that encourage the sale of models that emit less harmful exhaust gases. The state secretary will implement this recommendation.