Paying off debt to the government: improve customised payment schemes for vulnerable citizens

Arbitrary tax schemes; little thought for living expenses

The 3 largest government debt collectors in the Netherlands give little thought to vulnerable citizens whose debt payments are so high they are not left with enough money to live on. The payment schemes offered to thousands of people with problematic debts are less than optimal, especially if the schemes are customised.

Communication on standardised schemes is clear and transparent

If a standardised payment scheme is agreed with a citizen, communication about it from government debt collectors is clear and the scheme is accessible. This is important because many citizens are helped in this way. The Tax and Customs Administration alone agrees more than 165,000 standardised schemes a year and the Central Judicial Collection Agency (CJIB), which collects traffic fines, etc., agrees more than 122,000. Transparency and clarity also increase the propensity to pay off debts. In the Court of Audit’s opinion, the standardised schemes offered by the Tax and Customs Administration and CJIB are effective. CAK, which collects chronic care and social support insurance contributions, however, cannot say how many payment schemes it agrees or how much debt is repaid on time. At the Tax and Customs Administration and CJIB, 71% of debts are repaid on time. These standardised schemes prevent debts from increasing further and ensure that payments are actually made. The fact that standardised schemes are usually all that are needed to reduce payment arrears is good for the public purse. In total, schemes are agreed for many millions of euros every year.

Customised schemes fall short

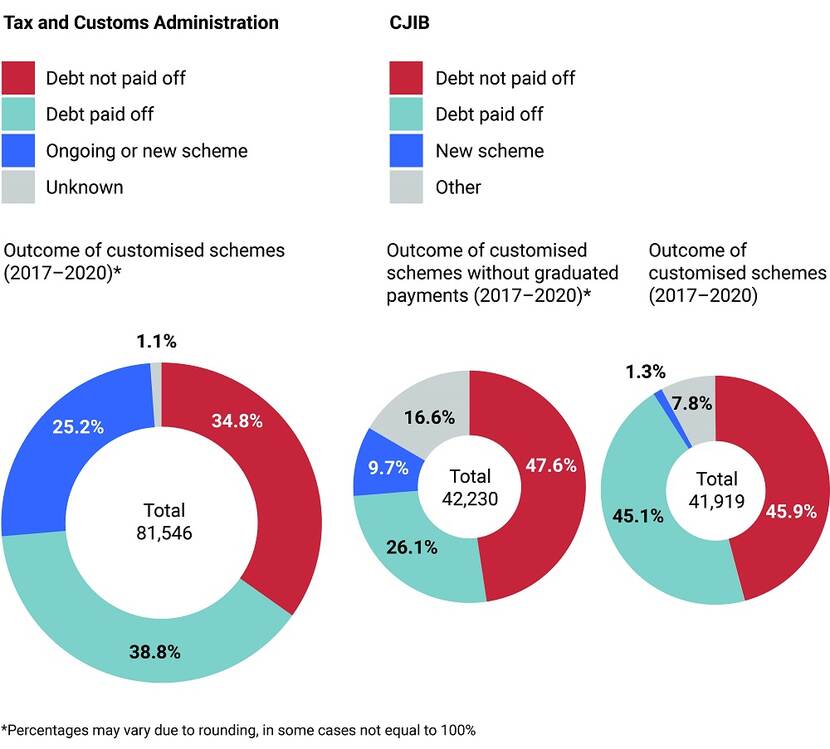

Standardised schemes, however, are not always appropriate. If someone does not have enough money to repay a debt to the government within the standard payment term or has a complex debt problem, the approach taken by the largest government debt collectors is inadequate. The Court of Audit concludes in an audit report published on 23 March 2023 that this is a cause of concern. On average, both the Tax and Customs Administration and CJIB agree 20,000 customised schemes every year. The customised schemes offered by the Administration, CJB and CAK are inadequately effective. The audit found that in 46-48% of the customised schemes agreed by the CJIB, payment was not received on time. At the Tax and Customs Administration, more than a third of payments were not made on time.

Less is paid in customised schemes than standardised schemes

Citizens are not informed in full, if at all, about customised payment schemes. Websites, documents and other forms of communication do not explain when agreements can be tailored to an individual’s circumstances. Even if tailoring is necessary, the Tax and Customs Administration, for example, does not explain that a scheme can last longer than 12 months, a missed opportunity according to the Court of Audit. More is possible only if a standardised scheme is refused and a citizen appeals against the offer. For many vulnerable citizens, however, initiating an appeal procedure is inconceivable on account of the stress and other deterrents.

In a customised agreement with the CJB or CAK, payments are not made over 2 or 3 years but can be spread out across as many as 6 years. Internal work instructions, however, do not explain who is eligible for such a scheme. It all depends on the CJIB or CAK employee who answers the telephone.

Subsistence level not ensured

Under the government debt collection policy, the government must ensure that people have enough money to cover their living expenses. The audit found that neither the CJIB nor CAK had clear internal agreements to calculate and ensure a subsistence level of income. There were no indications in the files that citizens’ ability to make repayments was taken into account. People can be living below the statutory subsistence level if they are paying off more than one debt. The Tax and Customs Administration has priority over other organisations and businesses to collect tax debts but takes no account of debts being paid to other organisations or institutions. Its payment schemes for people with large or problematic debts are not realistic and are feasible only on paper. A debtor can then be left with too little money to get by. Long-lasting debts lead to stress and make citizens even more vulnerable.

Response of the Minister for Poverty Policy

The Minister for Poverty Policy, Participation and Pensions wrote in her response to the audit report that various government organisations would work together to improve debt collection and prevent or address problematic debts. The CAK and CJIB have announced improvements in response to the Court of Audit’s findings. The Tax and Customs Administration has also undertaken to improve the information it provides on the options available when agreeing a payment scheme.

The Court of Audit notes in its afterword that the minister does not refer to the problem that customised payment schemes offered by the 3 organisations can leave citizens with less than subsistence level income. Each of the organisations has its own standards. Clear agreements are needed as quickly as possible to ensure that citizens have at least subsistence level income.