How will Brexit affect the Netherlands?

Following ratification of the withdrawal agreement by the European Union and the United Kingdom, Brexit took place on 31 January 2020, Since then the UK has no longer been part of the EU. Negotiations then began on the future relationship between the EU and the UK, culminating in a Trade and Cooperation Agreement on 24 December 2020.

As the Netherlands has longstanding and close bonds with the UK, Brexit affects the Netherlands in many ways. These bonds are not just financial and economic, but also political, as the Netherlands and the UK often shared the same views on policies and funding. The following areas have been impacted by Bexit:

- trade and industry,

- healthcare,

- customs and excise,

- education and research,

- public finances.

Long-term and short-term costs

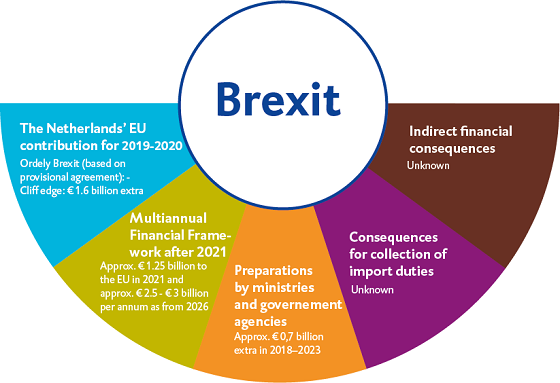

Our audit of the Dutch government’s preparations for Brexit that we published on 10 December 2018 lists the various costs of Brexit for the Netherlands (data for mid-2018):

Among other things, we found that the short-term (i.e. in 2019-2020) direct costs to the Netherlands of a ‘no-deal’ Brexit would be €1.6 billion. At the time our report was published, the date set for the UK’s departure from the EU was 29 March 2019. The actual Brexit date was 31 January 2020. A trade agreement was concluded on 24 December 2020, thus averting a no-deal Brexit.

Owing to Brexit the Netherlands will have to make a higher contribution to the EU budget – even if it remains unchanged. This is because after, following UK’s exit, 27 rather than 28 member states will be responsible for the EU budget, to which the UK in the past had been a net contributor.

The Netherlands’ contribution to the EU will be affected not only by Brexit but also by the EU’s Multiannual Financial Framework (MFF) for 2021-2027. The financial consequences of the new agreement are disclosed in the Ministry of Foreign Affairs’ budget for 2021. Under the agreement reached by the European Council on 21 July 2020, the Netherlands’ total contribution to the EU will increase from nearly €9 billion in 2021 to nearly €10 billion in 2027.

There had been a risk that the Netherlands would lose some or all of the current rebate on its EU contribution following the UK’s departure. A rebate reduction had been suggested in one of the European Commission’s proposals for the MFF 2021-2027. In the agreement reached by the European Council, however, the Netherlands will receive a higher annual rebate of €1.92 billion (in 2020 prices) in the forthcoming MFF period. Furthermore, the fee the Netherlands receives to cover the cost of collecting import duties will be raised from 20% to 25%.

Impact on Customs

In our 2018 audit report, we wrote that Dutch Customs would not be able to prepare itself fully for a ‘no-deal’ Brexit on 29 March 2019. The Customs authority claimed to need additional staffing of 928 FTEs in order to handle a no-deal Brexit, and said that it expected to have recruited 300 extra FTEs by the time that our audit was completed in mid-2018. In September 2019, we found that Customs expected to have recruited 596 FTEs by 1 October 2019, and that it was well on course in terms of the recruitment and deployment of Brexit staff.

Impact on the Dutch economy

The Netherlands Bureau for Economic Policy Analysis (CPB) examined the possible impact on Dutch economy. It calculated that the decline in trade with the UK would cost the Dutch economy around 1.2% of its gross domestic product in 2030, i.e. approximately €10 billion. In an update in 2021 the CPB concluded that the Trade and Cooperation Agreement (see below) signed at the end of December 2020 in broad lines corresponded to a free trade scenario, without tariffs. The resultant decline in trade will reduce the Netherlands’ GDP by between 0.9% and 1.5% in 2030, with lost income of approximately €8 – €13 billion.

The Brexit process

In the referendum held on 23 June 2016, 51.9% of British voters voted in favour of the UK’s departure from the EU. The European Commission (representing the EU) and the UK began Brexit negotiations on 19 June 2017. They reached agreement on 17 October 2019 on the terms of the UK’s exit, including on the rights of EU citizens in the UK, on the border between the Irish Republic and Northern Ireland, and on the final financial settlement between the UK and the EU. The date eventually agreed for Brexit was 31 January 2020. This was also the date on which a transition period started, during which the UK and the EU negotiated the nature of their future relationship. These talks were completed on 24 December 2020.

Trade and Cooperation Agreement

The EU and the UK concluded a Trade and Cooperation Agreement on 24 December 2020. The EU member states agreed to the agreement on 29 December 2020 and the UK parliament on 31 December 2020. The European Parliament ratified the Trade and Cooperation Agreement on 27 April 2021.

The agreement took effect and the new rules came into force on 1 January 2021. At present it is not known precisely how it will affect the Netherlands but it is already clear that a lot will change in many areas. There have since been checks and red tape at the borders with the UK, for instance at the ports of Rotterdam, Hook of Holland and IJmuiden. Dutch fishers can catch about 25% less fish in British waters to the end on 2026, after which new talks will be held on fisheries. In addition, Dutch students can no longer study in the UK under the EU Erasmus exchange programme. The agreement’s precise impact on the Dutch economy will become clearer in the coming period.

New customs procedures and border formalities have been phased in on the British side since 1 January 2022. They have been published in the Border Operating Model (BOM). BOM is currently being replaced with the Border Target Operating Model (TOM) TOM, too, is being phased in.

- More about the negotiation process

Brexit Adjustment Reserve

During its meeting of 17-21 July 2020, the European Council asked for a proposal to establish a Brexit Adjustment Reserve to compensate the member states and sectors hit hardest by Brexit, based on the member states’ trade with the UK and the fish caught in the UK exclusive economic zone. On 25 December 2020 the European Commission issued a proposal. Following approval by the European Parliament on 15 September 2021, the Council approved the proposal on 28 September, thus completing the legislative process. Under the Brexit Adjustment Reserve, the Netherlands can claim about €866 million. The remainder is intended for the fisheries sector. The Netherlands is the second largest recipient, after Ireland, of the Brexit Adjustment Reserve. The allocation to all member states is available here.

Funds released from the Brexit Adjustment Reserve are spent in the Netherlands by the Netherlands Enterprise Agency (RVO). See: https://www.rvo.nl/subsidies-financiering/bar. The funds are applied chiefly for the benefit of the business community and the fisheries sector. There are two compensation schemes and a trade programme for the business community. For the fisheries sector, the Ministry of Agriculture, Nature and Food Quality (LNV) LNV is seeking to restructure the fishing fleet (the SVV scheme), mitigate loss of income in the fisheries sector (the SIV scheme) and via the VSB scheme compensating for vessels taken out of service because of Brexit.

On 18 July 2022, the European Commission approved a Dutch aid measure to support the fisheries sector. On 15 December 2022, the Commission gave the green light for a liquidity facility and a suspension of activity facility for the fisheries sector. The facilities are open from 3 April 2023 to 30 June 2023. On 31 October 2022, the Commission approved a Dutch compensation programme for businesses that incurred additional costs for new customs procedures following the UK’s departure from the EU.

The Minister of EZK informed the House on 14 March 2023 that approximately €280 million would be underspent on the General Business Scheme and the Trade Programme. These funds, which were provided for Brexit, will be added to REPowerEU.

The European Court of Auditors published an opinion on the Brexit Adjustment Reserve 1 March 2021. It pointed to the architecture of the Reserve, under which Member States would receive an unusually high level of pre-financing without having to give the European Commission advance details of the measures to be funded. While this would allow for a swift reaction to an exceptional situation, the Commission would not assess the eligibility and appropriateness of these measures before the end of 2023.

The auditors warned that the proposed structure and timing would increase the risk of sub-optimal and ineligible measures.

Final settlement of the Withdrawal Agreement

When the UK left the EU, it agreed to settle all outstanding obligations to the EU. The most recent estimate of this ‘divorce bill’, by the House of Commons, is that the net cost to the UK will amount to approximately ₤ 34 billion (approximately €39 billion) in 2020-2064. The European Court of Auditors also considers the final settlement of the Withdrawal Agreement in its annual report for 2020.

In its opinion on the accounts, the European Court of Auditors notes that the Commission had estimated that the UK owed the EU €49.6 billion as at balance sheet date and the EU owed the UK €2.1 billion. On balance, the EU’s accounts therefore included a net receivable from the UK of €47.5 billion.