How has the EU responded to the COVID-19 crisis and what is the impact on the Netherlands?

The outbreak of coronavirus in China at the end of 2019, and its spread across Europe and the rest of the world from February 2020 onwards, started out as a health crisis before evolving into a more general crisis touching on all segments of public life.

Between spring 2020 and 2022, EU member states gradually relaxed economic and social restrictions and later tightened them up again. With the increase in vaccination rates in the EU, the measures were scaled down further as from February 2022. The European Commission’s policy to overcome the COVID-19 crisis will be continued for the time being (see below).

This page lists the main financial measures taken by the EU to support the healthcare system and the economy. For information on policy in general, we refer you to the COVID-19-sites launched by the European Commission and the European Council.

Financial measures taken by the EU to support the healthcare sector

The EU has taken the following measures to support the healthcare sector.

- Acting on a proposal by the European Commission, the Council of the European Union and the European Parliament agreed to activate an Emergency Support Instrument (ESI). This allows the Commission, among other things, free up resources for the rescEU initiative, which involves building up a strategic stock of vital medical equipment – and distributing it if necessary. The funding for the two instruments stands at just over €3 billion, a sum allocated from the EU budget. The EU member states together will be required to contribute an extra €3 billion to the EU budget.

- Approximately €1 billion has been released from the EU Horizon 2020 research and innovation fund to combat the COVID-19 pandemic and a further €152 million had been pledged. Click here for more information.

- On behalf of the EU, the European Commission’s Joint Negotiation Team (consisting of the Commission, France, Germany, Italy, Netherlands, Poland, Spain and Sweden) negotiated with vaccine developers and signed 6 procurement contracts in the course of 2020 for nearly 2 billion doses. The Commission is providing about €2.7 billion in support from the Emergency Support Instrument. In total, the EU will have procured over 4.5 billion doses by the end of 2022. Click here for more information.

In addition to the above measures, the EU also supported the member states' healthcare sectors by issuing medical guidelines, and helped member states to obtain personal protective equipment for their healthcare workers.

Economic support for EU member states

On 9 April 2020, European finance ministers reached agreement on a €540 billion financial support package for countries hit most severely by the COVID-19 crisis. The package consists of the following components:

- €240 billion from the European Stability Mechanism (ESM) emergency fund;

- €200 billion in company credit distributed by the European Investment Bank (EIB);

- €100 billion for a new temporary instrument known as Support to mitigate Unemployment Risks in an Emergency (SURE). By the end of December 2022, a total of €98.4 billion had been disbursed to 19 member states.

Click here for a full list of the components of the support package.

On 13 March 2020, the European Commission proposed a Corona Response Investment Initiative (CRII). A total of €37 billion in non-utilised resources from the European Structural and Investment (ESI) Funds will be used for COVID-19-related support for the healthcare sector, small and medium-sized enterprises (SMEs), vulnerable sectors and the labour market. On 2 April 2020 this initiative was followed up by an additional CRII+ package.

CRII and CRII+ are part of the Recovery Assistance for Cohesion and the Territories of Europe (REACT-EU), for which €47.5 billion is available for 2021 and 2022 via the ESIF, to be applied for a green and digital economic recovery.

Next Generation EU and the Recovery and Resilience Fund

On 27 May 2020, the Commission presented a proposal for a €750 billion recovery fund known as Next Generation EU in conjunction with a proposal for a new EU multiannual financial framework for 2021-2027

The Commission will be allowed to borrow up to €750 billion on the capital markets, to be repaid between 2028 and 2058.

- More information on the package is available here

Agreement was reached on the Recovery and Resilience Facility on 18 December 2020. This facility is at the heart of Next Generation EU. It will make €672.5 billion available in loans and grants to support reforms and investments in EU member states. To be eligible for support, member states draft a recovery plan setting out their planned investments and economic reforms. The reforms and investments must be completed by 31 December 2026. All member states have submitted plans. The Netherlands submitted its plan on the 8 July 2022 and was the last member state to do so. The plan can be accessed here (in Dutch). The European Commission approved the plan on 8 September 2022. The Netherlands accordingly became eligible for €4.7 billion in grants. It will make its first payment request to the Commission in autumn 2023. Subject to the Commission’s approval, the first tranche will then be disbursed.

General information on the Recovery and Resilience Facility is available here.

The Commission has disbursed more than €97 billion in grants and over €47 billion in loans. The European Commission keeps information on how much money has been awarded to which member states and for what purpose on this scoreboard.

Measures to offer EU member states more financial flexibility

The Stability and Growth Pact (SGP) sets limits on the member states' budget deficits (3% of GDP) and government debt (60% of GDP), and states how countries that deviate from these limits must set about achieving them.

Owing to the COVID-19 crisis and acting on a proposal from the European Commission dated 20 March 2020, the Council of the European Union and the European Parliament agreed to activate the SGP’s general escape clause. This allows EU member states to take all the financial measures that they feel are needed at a national level in order to kickstart the economy without violating the rules of the Stability and Growth Pact. On 23 May 2022, the European Commission decided, partly in view of the uncertainty caused by the war in Ukraine, to de-activate the general escape clause in 2024.

On 26 March 2020, the European Central Bank (ECB) launched its Pandemic Emergency Purchase Programme (PEPP), under which up to €750 billion worth of private and public sector securities could be purchased under the ECB’s responsibility. The initial purchase envelope was increased to a new total of €1,850 billion. Not only will the programme make it less expensive for member states to raise capital, governments will also be able to support companies and households that have run into difficulties due to the COVID-19 crisis. The ECB de-activated the programme at the end of March 2022. By March 2023, more than €1,680 billion in member state government debt had been repurchased, including more than €83 billion in Dutch government debt.

- More information is available here.

Temporary relaxation of EU rules on state aid

In order to prevent unfair competition, as a rule EU regulations forbid governments from providing state aid to the corporate sector.

In exceptional cases, the European Commission may give its consent to the provision of state aid subject to certain stringent conditions. The European Commission considers the COVID-19 crisis to be an exceptional situation, and has a temporary policy to support the member states' economies. The policy is set out in the Temporary Framework for state aid measures to support the economy in the current COVID-19 outbreak. The Temporary Framework has since been amended on 6 occasions.

All EU member states must ask the European Commission for permission to provide temporary state aid during the current COVID-19 crisis.

This temporarily state aid regime will end on 30 June 2022. On 22 April 2020, the European Commission approved a Dutch loan guarantee scheme of up to €10 billion to support the Dutch economy. On 13 July 2020 the European Commission approved a Dutch proposal to grant €3.4 billion to KLM. In May 2021 the European Court of Justice ruled that the European Commission had provided inadequate reasons for its decision and ordered it to make a new decision. The Commission again approved the support provided to KLM on 19 July 2021.

The European Commission has approved proposals for all EU member states in the context of the new, temporary state aid regime. According to the Commission, the total amount involved at year-end 2022 was approximately already €3.1 billion (Source: calculation by the Netherlands Court of Audit). A list of all proposals approved is available here.

What is the impact on the Netherlands?

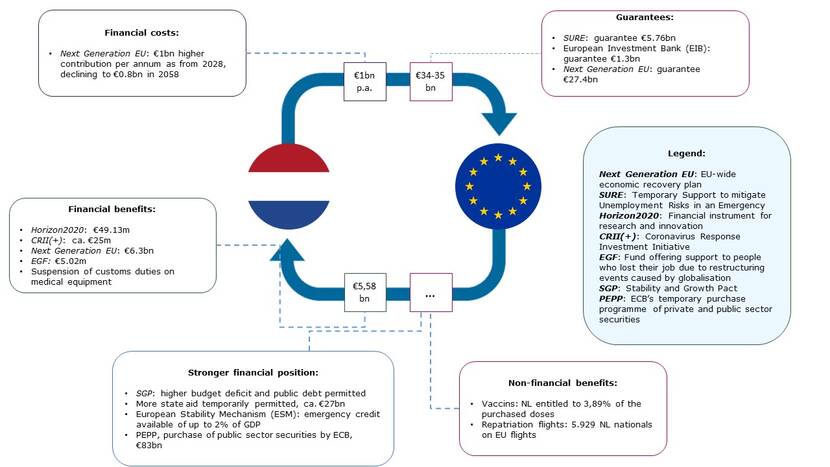

EU measures to combat the COVID-19 crisis are also relevant to the Netherlands. They can be a source of income for the country and give it more financial scope for expenditure. They can also entail costs to the Netherlands, for example in the form of additional contributions to the EU or because the Netherlands, together with other member states, must guarantee expenditure at EU level. The impact of EU measures on the Netherlands is summarised in figure 1.

A more detailed summary of the costs and benefits to the Netherlands of EU COVID-19 measures is provided in this table. A relaxation of the rules of the Stability and Growth Pact has enabled the Netherlands and other member states to let their annual budget deficit exceed the limits of the SGP. The temporary framework for state aid allows the Netherlands to grant more state aid. It used this option to award approximately €27 billion in state aid by 3 November 2022 (source: the Commission’s State Aid Brief with appendix of October 2022). This aid had to be approved by the Commission. It included support for KLM and support for public transport. The temporary framework expired on 30 June 2022. See the Eurostat State Aid Scoreboard for all data, including COVID-19 support, on Dutch state aid expenditure to the end of 2021.

What impact do these EU measures have on the work of the Netherlands Court of Audit and the European Court of Auditors?

The Netherlands Court of Audit monitors and audits the Dutch central government and its associated institutions. Power to audit EU resources invested directly in member states lies with the European Court of Auditors (ECA). If EU resources are spent in the Netherlands, the Netherlands Court of Audit also has audit powers in nearly all cases.

The ECA has published opinions on several topics, such as the CRII+ package, opinion on REACT-EU and Recovery and Resilience Facility (RRF).

On 9 December 2020, the ECA published a report on the EU measures to mitigate the economic impact of the COVID-19 crisis, and on 18 January 2021 a report on the public health challenges facing the EU on account of the crisis. The ECA recently issued a number of reports on the Recovery and Resilience Facility, including one on the control system developed by the Commission.

The 2008 financial crisis showed that European measures could affect the ability of supreme audit institutions to perform independent audits. This may be relevant to audits of the use of resources from the ESM emergency fund, and to audits of the easing of capital requirements for banks in the euro area. We published a blog about the ESM entitled The ESM and the importance of independent audits.

We have published a blog on the banking union entitled European banking union shuts the doors to audit offices.