Insight into additional funding of the third Rutte government

Traceability and reasons for measures

The reasons given in the budget documents the House of Representatives and the Senate receive from the third Rutte government on how the additional funds the government has budgeted will be spent vary widely. In a number of cases it is uncertain whether parliament will be able to identify the results of the additional funding. These findings are presented in an audit report issued by the Netherlands Court of Audit on the reasons given for the additional expenditure for the measures agreed in the coalition agreement.

Plans prepared for some additional expenditure

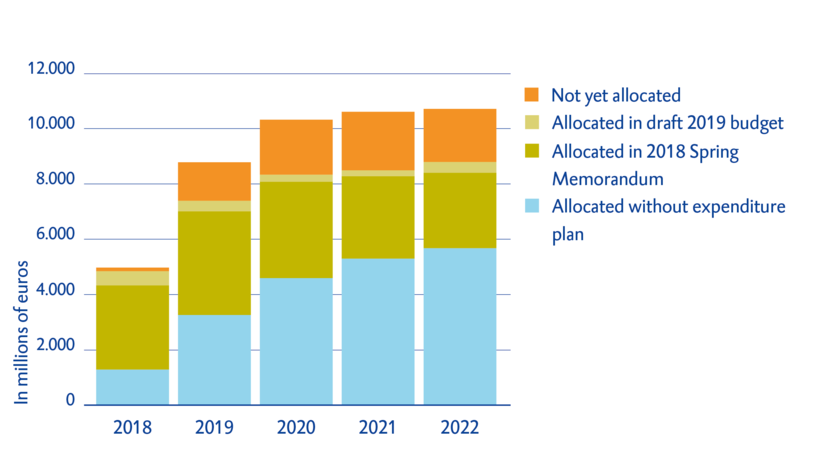

Some of the additional funds have been parked on the Minister of Finance’s ‘supplementary account’ and will not be released until ministers present concrete plans that can be evaluated. This new procedure matches the government’s ambition to improve the reasons given for policy in advance and increase insight into the efficiency of expenditure. Ministers may not draw on their budgets until the Minister of Finance has approved a detailed expenditure plan and parliament has agreed to the expenditure. The Minister of Finance allocated €4.1 billion of the 2019 draft budget on the basis of approved expenditure plans. The government has allocated a further €3.3 billion without expenditure plans (this amount will increase in the years ahead). Some €1.4 billion of the €8.8 billion provided for in the coalition agreement still has to be allocated for the 2019 financial year. This amount has been placed on the supplementary account. The draft budget for 2019 must still be approved by parliament in the coming months.

The Court of Audit analysed 19 measures at all the ministries. The expenditure plans for some of the funding are uncertain and it is not clear how parliament can determine whether the intended results were actually achieved. In a number of cases, this information is not provided in the budget documents or in letters or policy memoranda submitted to the House of Representatives. Parliament needs this information to approve the budget. According to the Court of Audit, the new procedure clearly explains how much additional funding a minister can spend and when. But it is difficult to follow the additional amounts in the budget articles. Parliament can bring most influence to bear when it approves (or amends) the budget. An appendix to the Court of Audit’s report provides information on how additional funding for each measure is recognised in the ministers’ budgets. This information was provided by the Ministry of Finance at the Court of Audit’ request.

Some additional expenditure earlier, some in draft 2019 budget, some not yet allocated

Why did we audit the government’s additional expenditure?

The findings on the traceability and allocation of additional expenditure are based on an audit of individual measures for which additional funding had been earmarked. This descriptive publication is the first in a series of audits covering this subject. The Court of Audit is following the increase in expenditure over several years, focusing on the information available on additional funding. Our aim is to provide an insight into the results achieved by the additional spending. We will issue letters on the draft 2019 budget on 4 October 2018. They will consider our audit findings on the allocations made to each budget chapter. Our audit report is descriptive in nature and does not contain recommendations.

What standards and methods did we use in this audit?

Questions asked by the House of Representatives about the 2018 Spring Memorandum revealed that the House wished to receive more information on the allocation of the additional expenditure provided for in the coalition agreement. The House asked the Minister of Finance, for example, to explain how the additional expenditure had been allocated from the supplementary account and where it could find the information promised on the goals, efficiency and effectiveness of expenditure (in accordance with section 3.1 of the Government Accounts Act).

We examined how the procedure to allocate the additional expenditure had worked in practice. We also mapped out the current status of the allocation in the draft 2019 budget. Regarding the traceability and reasons for the additional expenditure, we selected one or two measures from the coalition agreement for each budget article. The selection considered the measures’ social relevance, financial importance and whether or not we had previously audited the same issue.