Improvements combating money laundering, time for the next step

Disclosure system not yet optimal

Private parties are disclosing more unusual transactions, law enforcement agencies are referring more cases to the Public Prosecution Service (OM) and more money laundering cases are being taken to court and prosecuted. The Netherlands Court of Audit concludes that there have been significant improvements combating money laundering in recent years but there are still opportunities to work more effectively. The Financial Intelligence Unit (FIU), law enforcement agencies and OM do not yet work optimally. They cannot guarantee that suspicious transactions with the highest risk will be investigated and ultimately prosecuted.

The Court has now carried out three audits on combating money laundering in the past 15 years. Following the two earlier audits (in 2008 and 2014), the Minister of Finance and the Minister of Justice and Security (J&V) committed themselves to strengthening their control and management of the confiscation system, improving insight into how disclosures of unusual transactions were dealt with and informing parliament systematically of the results of anti-money laundering measures. The Court concludes that information management is still inadequate.

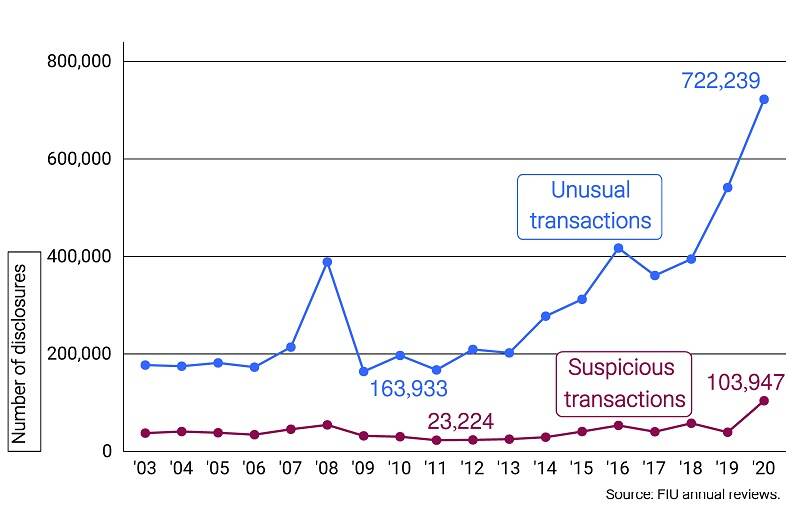

The audit found that disclosing institutions such as banks, money exchange bureaus, jewellers and notaries reported more unusual transactions to the Financial Intelligence Unit –Netherlands (FIU-NL) in the period 2003-2020. In the same period, FIU-NL classified more transactions as suspicious.

More unusual and suspicious transactions

These figures do not tell the whole story. The Court of Audit found that the law enforcement agencies and OM cannot guarantee that suspicious transactions with the highest risk will be investigated and prosecuted. They do not have the capacity to assess all suspicious transactions or to take further action where necessary.

The Court also found that law enforcement officers can unintentionally investigate the same suspicious transactions without knowing of each other’s work. FIU-NL reports suspicious transactions simultaneously to all the law enforcement agencies but the agencies do not make agreements on who will assess and investigate which transactions. The use of scarce financial expertise is therefore sub-optimal.

Furthermore, the law enforcement agencies are not informed why FIU-NL classifies a transaction as suspicious. FIU-NL cannot share all its information and the underlying reasons for it because it is classified as secret. This makes it difficult for the law enforcement agencies to identify and investigate natural and legal persons that were previously unknown to them and to select cases that will probably have the best results.

Finally, the Court of Audit concludes that the Minister of Finance and the Minister of J&V do not have sufficient insight and do not share sufficient useful information on the impact of anti-money laundering measures. The Court had come to the same conclusion in its earlier audits. Disclosing institutions could improve their disclosures of unusual transaction if they knew which transactions were of use to the law enforcement agencies. FIU-NL and the law enforcement agencies could use the information to improve their analyses and investigations and to improve coordination of their information sharing. As the fourth Rutte government has announced it will release additional funding to strengthen anti-money laundering measures, there are certainly opportunities to make improvements.