Gift tax exemption for owner-occupied homes

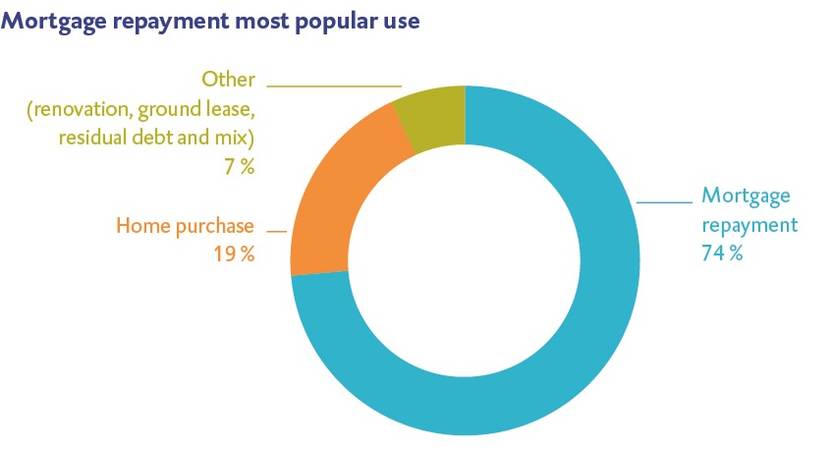

The temporary increase in the gift tax exemption for owner-occupied homes in 2013 and 2014 proved unexpectedly popular and a great deal of use was made of the scheme. In most cases (relating to an estimated 74% of the gifts), the scheme was used to pay down a mortgage. The scheme therefore probably contributed to the goal of reducing the overall mortgage debt and the number of homes in negative equity. We accordingly expect the permanent scheme, which came into force on 1 January 2017, to have a similar outcome.

Scheme used mainly to pay down mortgages

After many years in which home loans increased, the average mortgage debt has been declining since 2013. The number of homes in negative equity has also fallen. It is difficult to quantify the influence of the gift tax exemption on these developments. It can be said though that the scheme triggered an enormous increase in the number of gifts that were made. Furthermore, it has been used by people in a relatively weak mortgage position. Most of the people (an estimated 74%) used the scheme to reduce their mortgage debt. Earmarking the scheme ensured that the gifts were used for their intended purpose.

We found that the increase in gift tax exemption in 2013/2014 had led to a considerably higher loss of tax revenue than projected, as the number of gifts was far higher than foreseen. The increase cost €1,035 million, whereas €104 million had been budgeted.

The permanent scheme introduced in 2017 will probably have a far less pronounced effect on the number of gifts that are made. The spike in the number of gifts was probably due to the scheme’s temporary nature when it was introduced in 2013/2014. The permanent scheme introduced in 2017 will therefore probably have less impact. The Ministry of Finance has calculated that the permanent scheme will lead to the loss of €97 million in tax revenue per annum. Uncertainty about the number of gifts will influence the estimated tax loss and the scale of the outcomes.

Why did we audit gift tax exemption?

We carried out this audit in order to determine whether the increase in the gift tax exemption for owner-occupied homes would likely help achieve the schemes’ goals as from 2017: reducing mortgage debt and the number of homes in negative equity. We also wanted to encourage a wide-ranging evaluation of this policy in particular and this type of policy in general.

What are our recommendations?

Our audit found that the increase in gift tax exemption for owner-occupied homes probably did contribute to the goal of reducing overall mortgage debt and the number of homes in negative equity. To verify this assumption, the scheme’s effectiveness must also be investigated in the new situation. We recommend that the Minister of the Interior and Kingdom Relations (BZK) and the State Secretary for Finance have such a follow-up audit carried out. To this end, criteria must be formulated to measure the scheme’s success.

We also recommend that the number of gifts be monitored in the years ahead. Experience with the 2013/2014 scheme suggests that it is difficult to estimate the number of gifts in advance. If more than 20,000 gifts are eligible for the new scheme, the loss of tax revenue will again be higher than estimated. The number of gifts will also influence the scheme’s outcomes. The evaluation of the scheme should take this into account.

What standards and methods did we use to audit gift tax exemption?

For this audit we used several databases kept by the Tax and Customs Administration. The Administration’s Data & Analytics Department linked the following two datasets for us and then anonymised the information (stripped out the citizen service numbers).

- Gift tax returns (concerning all gifts made between 2010 and 2014)

- Income tax returns of all gift recipients

To gain an understanding of what the recipients did with the money they received, we followed the ‘housing tax behaviour’ of the people who were eligible for the scheme. We determined whether there had been changes in their mortgage debt, leases, residual debts or home purchases in the years following the receipt of the gifts.

To check whether earmarking the gift tax exemption had had the intended impact, we compared the expenditure patterns of recipients of earmarked gifts with the expenditure patterns of recipients of gifts that were not earmarked. To do so, we worked with a more detailed database that contained all one-off gifts made between 2010 and 2016.

Current status

The State Secretary for Finance and the Minister of the Interior and Kingdom Relations responded to our draft report on 22 November 2017. The full text of their letter has been posted on our website.

The state secretary and minister said they would take our recommendations to heart. They have already given an undertaking to the House of Representatives that the permanent scheme will be evaluated and our recommendations will be acted upon.