VAT on Cross-Border Digital Services

Enforcement by the Netherlands Tax and Customs Administration

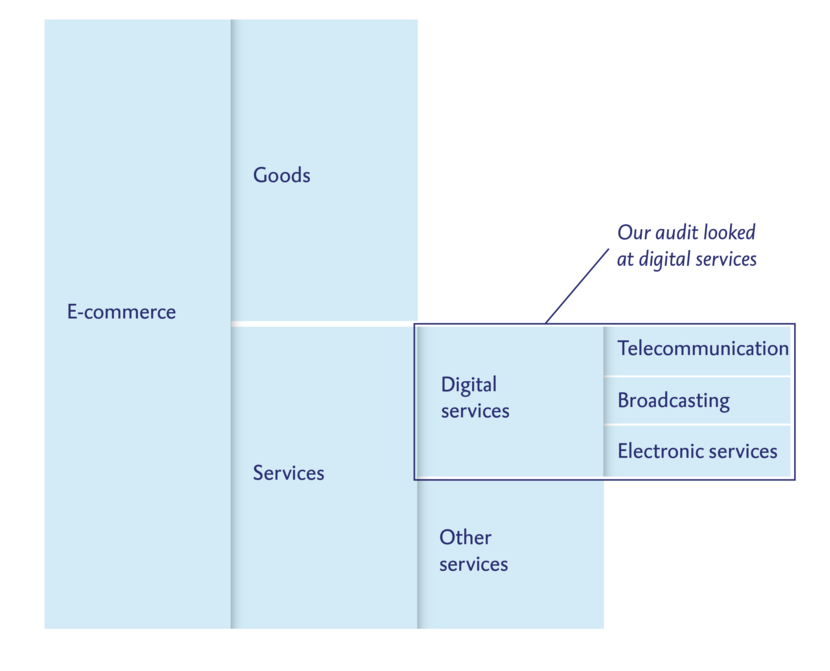

The growth of e-commerce presents a risk to the assessment and receipt of VAT. We have audited the Dutch Tax and Customs Administration’s enforcement of compliance with VAT obligations in respect of cross-border digital services (such as films, games and data storage) since 2015. The EU introduced a mini one-stop shop system (MOSS) in that year so that businesses could submit a single return to declare all their VAT payable in the EU. The system will be rolled out to include goods in 2021. The financial importance of VAT assessments will therefore be considerably higher, as will the importance of enforcement.

Enforcement of compliance with VAT obligations in respect of cross-border services must be strengthened

Our audit found shortcomings at the Tax and Customs Administration and we concluded that if it is to meet the challenges posed by rapid economic globalisation and the roll out of the mini one-stop shop system in 2021, the Administration must strengthen its enforcement of compliance with VAT obligations in respect of cross-border digital services.

Digital services, such as telecommunications, broadcasting and electronic services, are a separate category of e-commerce

What are our recommendations?

The Tax and Customs Administration can strengthen compliance with VAT obligations by:

- improving its organisation of the mini one-stop shop system

- sharing alerts with other EU member states

- carrying out risk analyses

- carrying out internet searches to detect tax evasion

- taking the initiative to improve cooperation among EU tax authorities.

Why did we audit the enforcement of compliance with VAT obligations in respect of cross-border digital services?

A poor grip on e-commerce can lead to substantial tax losses. The roll out of the mini one-stop shop system in 2021 to include goods will significantly increase the financial importance of VAT payments and thus the importance of enforcement.

What methods did we use to audit the enforcement of compliance with VAT obligations in respect of cross-border digital services?

To answer our audit questions, our investigation included a study of relevant policy documents and interviews with officials from the Tax and Customs Administration and the Ministry of Finance. To obtain quantitative information on the returns submitted in the mini one-stop shop system, we carried out data analyses of information compiled by the Administration by means of system queries. Where possible we compared our findings with those of cooperating EU supreme audit institutions that were carrying out or had already carried out audits in the field of VAT.

Current status

The State Secretary for Finance responded to our audit report on 8 November 2018. The audit was published on Wednesday 28 November 2018.