Focus on the Netherlands’ net payment position

The Netherlands’ contributions to and receipts from the EU

A recurrent theme in the negotiation of the European Union’s new Multiannual Financial Framework is which member states contribute more to the EU than they receive from it. In this investigation, the Netherlands Court of Audit precisely maps out this so-called net payment position. How much does the Netherlands contribute to the EU and how much money comes back each year in the form of EU finding? And why do The Hague and the European Commission disagree about how much the Netherlands contributes, the money is sent to Brussels, isn’t it? The Court of Audit lines up the facts and figures from the past 6 years to answer these frequently asked questions.

The report on the investigation, Focus on the Netherlands’ net payment position – The Netherlands’ net contributions to and receipts from the EU, explains what key figures, such as national income, are used to calculate the contributions. It outlines the history of how the EU is financed and how it has led to different definitions of the net payment position. It also looks at the effect of the rebate the Netherlands receives on its EU contributions. The European Council (ministers of foreign affairs) and the European Parliament are currently negotiating the allocation of the EU’s budget for 2021-2027 across the 27 member states.

Stubborn difference of opinion

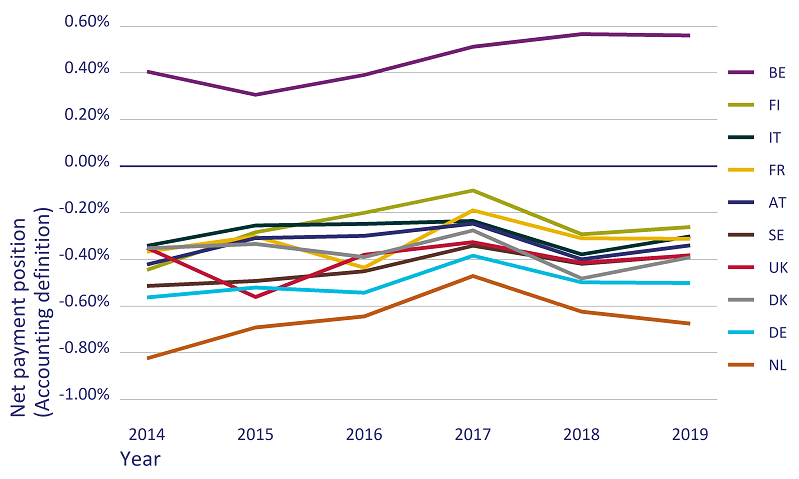

Last year, the Netherlands was the second largest net contributor as a percentage of national income to the EU after Germany – in 2014 it had been the largest. In the intervening years, the Netherlands also contributed more than it received from Brussels, but Germany and Sweden had been bigger net contributors. At least, that is the case if we use the European Commission’s figures. Under the accounting definition used by the Netherlands, the Netherlands was the largest net contributor to the EU in every year between 2014 and 2019. This is because The Hague includes all receipts from and contributions to the EU in its definition, including customs duties (import levies) that are collected in the port of Rotterdam and elsewhere. The European Commission uses another definition and does not count some national contributions, such as customs duties, and receipts to determine which countries are the biggest contributors or recipients. This difference of opinion has been reflected in the figures on the Netherlands’ contributions to the EU and its receipts from Brussels in the form of grants and other funds since the 1990s. The Court of Audit does not take a stance on this difference. The report does not include opinions or recommendations.

Under the accounting definition, the Netherlands was the biggest net contributor.

Under the same definition, Belgium becomes a net recipient

Rebate on excessive contributions

The report also looks at the effect of the rebates that some member states receive on their contributions. The Netherlands and certain other prosperous countries that contribute more to the EU than they receive from it have enjoyed a rebate on their contributions since 2002. At the insistence of its prime minister, Margaret Thatcher, the United Kingdom received a rebate in 1985. Since this year, the UK has no longer been a member of the EU.

The Netherlands’ net payment position in 2019 was €5.5 billion

The net payment position is indicative of the direct financial flows to and from the EU but says nothing about the EU’s social costs and benefits. Under the European Commission’s definition, in 2019 10 of the then 28 member states contributed more to the EU than they received from it. This is not so under the Netherlands’ definition; Belgium becomes a net recipient instead of a net contributor because the accounting definition counts funds Belgium receives for the EU institutions it hosts. Spain and Ireland also become net contributors under the accounting definition.

In 2019, the Netherlands contributed €8.1 billion and received €2.6 billion, producing a net payment position of €5.5 billion. Under the Netherlands’ accounting definition, its net contribution was equal to 0.67% of gross national income, in comparison with 0.35% under the European Commission’s definition.

What methods did we use in this investigation?

To carry out this investigation, we compared the accounting definition used by the Netherlands with the operating budgetary balance definition used by the European Commission. The Dutch Minister of Foreign Affairs informs the Dutch parliament about EU contributions and receipts each year. The Commission, however, publishes different figures calculated using its own definition. The Court of Audit explains the background to these differences and provides factual information on the formal positions taken by the European Commission and the Netherlands over the years. Various documents issued by the European Commission and the Dutch Ministry of Foreign Affairs and Ministry of Finance were studied for this investigation.

Why did we investigate the net payment position?

The net payment position is one of the elements in the current negotiations about the EU. The negotiation of the Multiannual Financial Framework for the next 7 years will determine whether any changes are made. Heads of state and government in the European Council have provisionally agreed that the Netherlands (and certain other member states) will continue to receive a rebate in the years ahead. Furthermore, the remuneration of the costs incurred to collect customs duties will be increased. The European Parliament must still approve this provisional agreement.

Current status

The report was published and submitted to parliament on 14 October 2020. Other interested parties will also be informed of our findings.