The Netherlands pays more into the EU budget than it receives in grants. In other words, it is a net contributor.

In discussions about the MFF and the annual EU budget, one of the main topics is how the Dutch contributions to the EU and its receipts from the EU work out on balance. It is as a result of this calculation that the Netherlands is classified as a ‘net contributor’.

The Netherlands’ contribution to the EU is the sum of:

- traditional own resources of the EU (such as customs duties);

- a percentage of VAT resources;

- a contribution based on gross national income (GNI-based contribution);

- a contribution based on non-recycled plastic packaging waste.

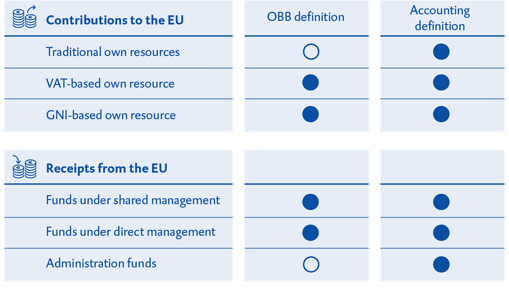

A factor that complicates calculation of the Netherlands’ net payment position is that there has long been a difference of opinion between the Netherlands and the European Commission on the calculation method.

Unlike the Netherlands used to do, the Commission does not recognise traditional own resources (customs duties) as a member state contribution. Member states, it argues, collect the duties charged on goods imported from outside the EU on behalf of the EU.

Since many goods are imported through the port of Rotterdam, the Netherlands collects a considerable amount of import duties. To give an impression, in 2024 the Netherlands collected import duties to an amount of €3.1 billion, more than 40% of the Netherlands’ total contribution in that year (source: § 3.5.2 of the Central Government Annual Financial Report 2024).

Until recently the Netherlands applied a different – accounting – method that includes net customs duties (i.e. customs duties net of the fee the Netherlands receives for collecting the duties) as a contribution to the EU.

The Netherlands is a net contributor under both definitions, but there is a significant difference in the positon. In 2012, 2020 and 2023 the Court of Audit calculated the net position of the Netherlands and the other member states using both methods.

The Netherlands has not returned to this difference of opinion in recent years. For the first time, article 3.1 of the Ministry of Foreign Affairs’ budget for 2024 does not include customs duties as a contribution to the EU, but presents them separately as customs duties under article 3.4. The Central Government Annual Financial Report states that in a sense the Netherlands’ budget for customs duties is no more than a conduit and the Netherlands collects the duties on behalf of the European budget.

Figure 1: Focus on the Netherlands’ net payment position

In fact, the Netherlands is a net contributor under both definitions, but the size of the net contribution differs considerably depending on the definition. In 2012, 2020 and 2024, the Netherlands Court of Audit showed how the calculations based on the two definitions panned out for the Netherlands (and the other EU member states).

More information